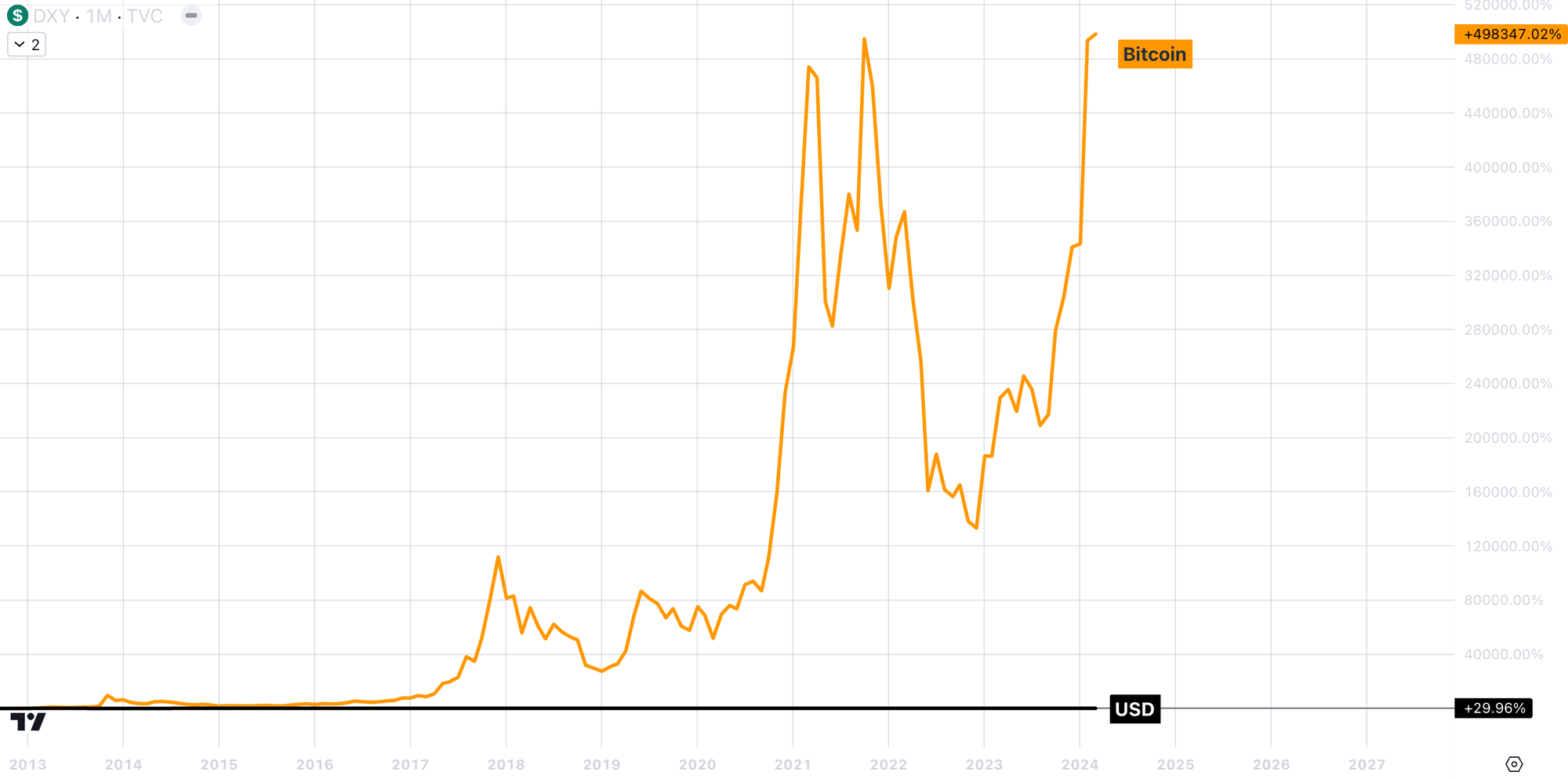

The price to acquire one Bitcoin is projected to continually be on the rise as limited supply is eaten up daily, along with supply shocks occurring roughly every 4 years through Halving Events. Assuming continuity of Bitcoin price data, Bitcoin is projected to be worth $1M faster than the average human can acquire $1M in USD by working. This means that your hard-earned USD is constantly depreciating against the growth of Bitcoin. (See Bitcoin vs. USD chart below).

If The Dollar Is Destined To Collapse…

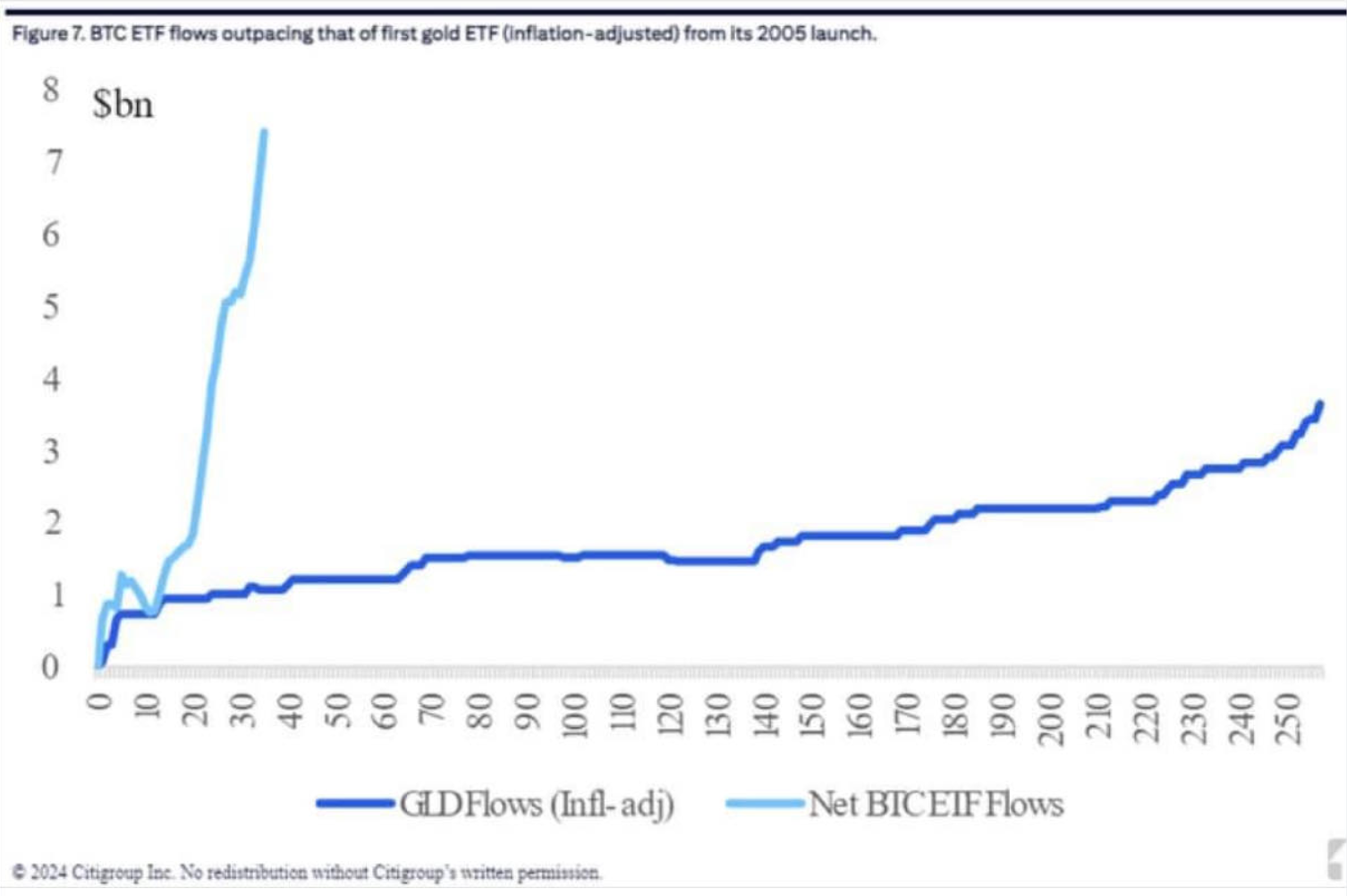

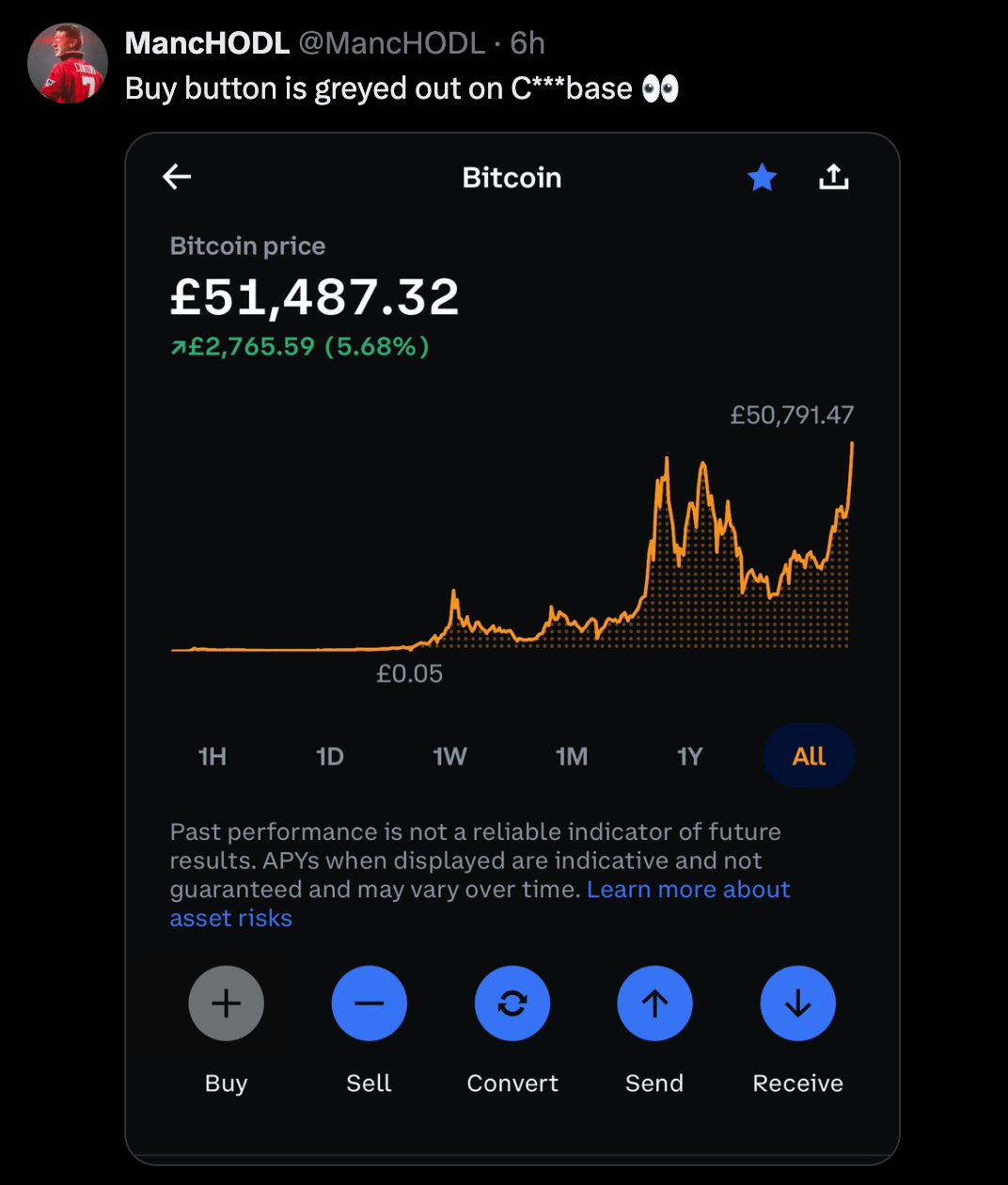

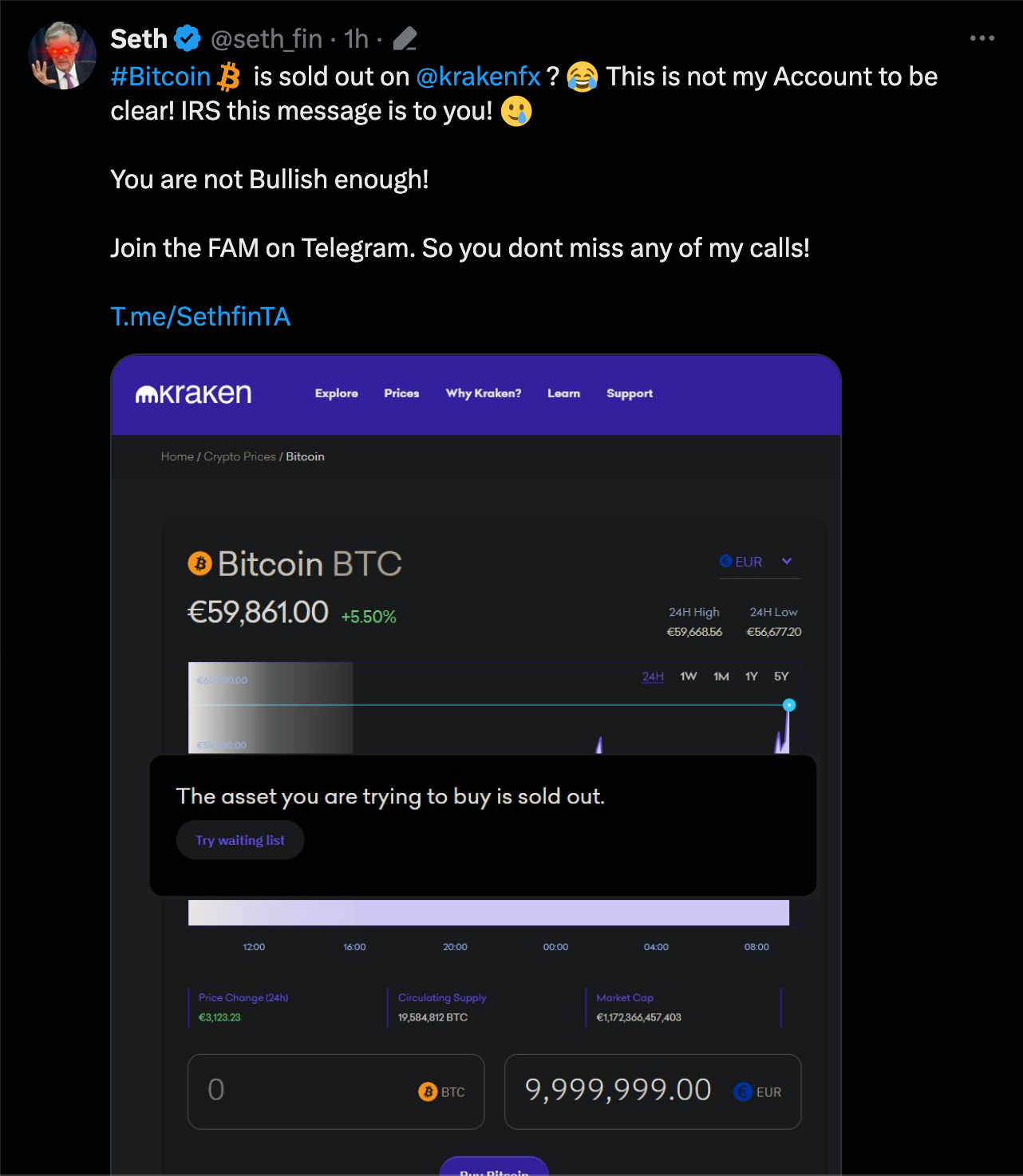

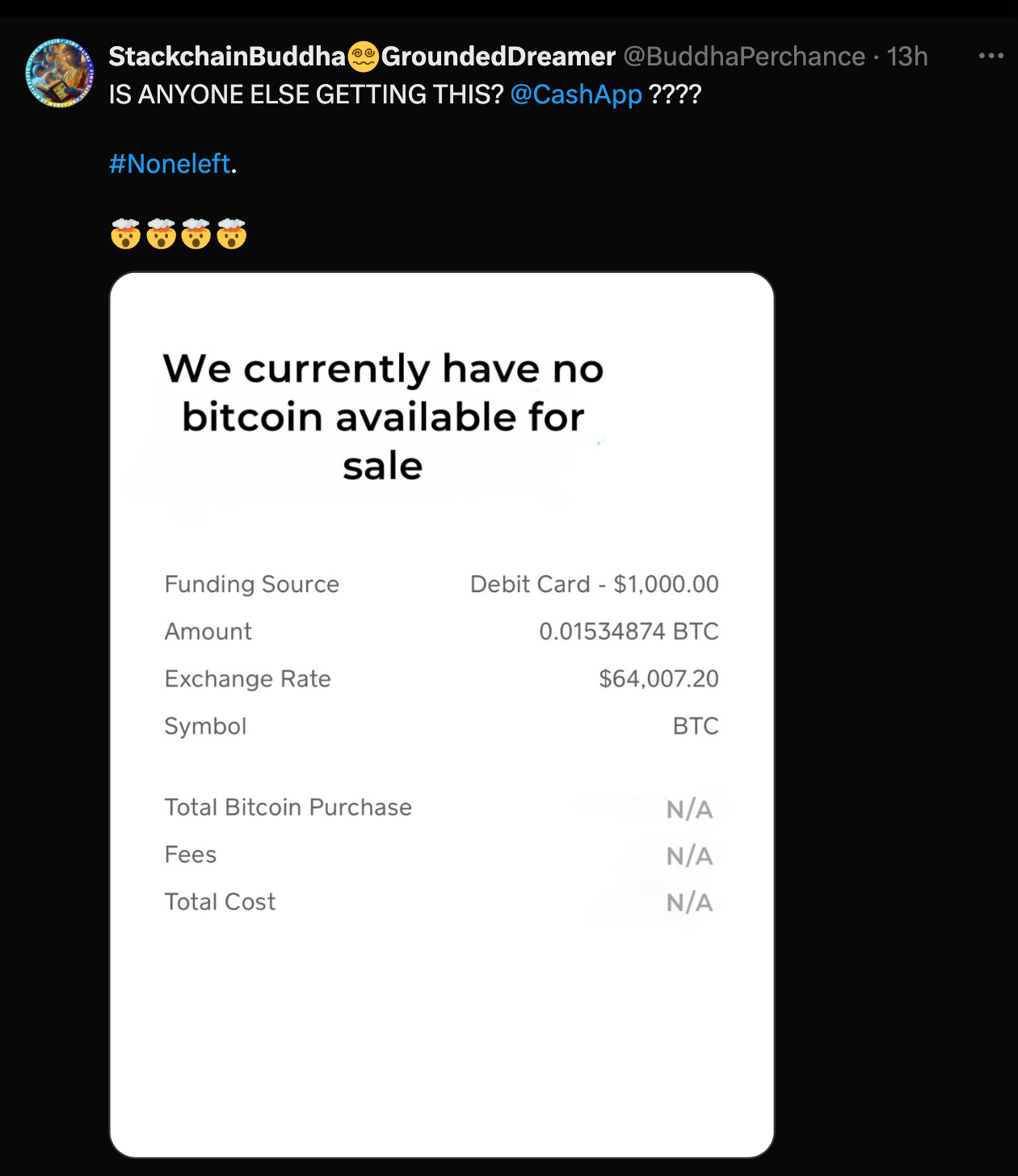

Then I believe institutions will use what will become devalued (USD) to purchase that which potentially will become most valuable (Bitcoin). Could this be why there has been such a high accumulation of Bitcoin by institutions by means of Bitcoin ETFs recently, and why on March 4, 2024 Coinbase, CashApp, and Kraken grayed out their Bitcoin buy button since there was 0 Bitcoin left to buy? (See Gold EFT vs Bitcoin EFT Accumulation and X account images below).

If Bitcoin (Believed By Many) Becomes The World Reserve Currency...

Then those who don’t own Bitcoin now will have to pay an extremely high premium to acquire it once the 21M circulating supply is accounted for, and did you know currently 94% of the 21M Bitcoin supply is owned by 1% of the world's population? This means when Bitcoin becomes a desired asset globally, you will have 99% of the world racing after the remaining 6%.

I do worry sometimes what will be required, or asked of you, by those who own it, for you to obtain it to buy or sell goods if Bitcoin reaches this global status.

Cathy Woods Predicts Bitcoin Could Hit $1.5M By 2030

Assuming this prediction comes true, this means that within 6 years, spending $67,000 today to acquire one Bitcoin, could be worth $1.5M by 2030.

What people are not realizing, is that it’s currently taking the average American 14.7 years to earn $1M gross. So to be able to buy one Bitcoin at $1.5M, you would need roughly $3M in gross income by 2030 (assuming 50% was allocated towards taxes and living expenses) to purchase just one Bitcoin.

In other words, buying $67,000 worth of Bitcoin right now and simply holding it for the next 6 years, would achieve the same earning power as you working a $68K/year job, 40 hours a week, for the next 21.17 years.

Let that sink in.

Now let's assume Bitcoin fails to reach this $1.5M prediction by 2030, one thing remains clear, every dollar you make is depreciating by roughly 3.09% a year, whereas that same dollar put into Bitcoin has averaged 575% return per year for the last 7 years. (Yearly growth and decline of Bitcoin chart below).

Now with all this in mind, the question for some still remains, what if Bitcoin goes to zero? To answer this, let me leave you with a quote from Michael Saylor: "Bitcoin is either going to $1 million, or zero."

So ask yourself, knowing this data, is your cash not worth at least 'some' exposure to Bitcoin?

For those who had a lightbulb 💡 moment, grab a membership and follow along as I teach you how I am accumulating and trading crypto every Tuesday and Friday in our membership for financial freedom.

Disclaimer: This is not intended to be financial or trade advice. These are my speculative opinions only. Cryptocurrency is extremely risky and you could lose everything. Please consult a licensed financial advisor before purchasing crypto.